Guest post by Bronagh Dobson

Over the many years I have spent creating reports for boards and senior decision-makers, one principle has always been true: the more accurate and relevant the reporting, the better the leadership’s capacity to make informed decisions. Poor data, on the other hand, can set up even the most brilliant team to flounder or fail.

Over the many years I have spent creating reports for boards and senior decision-makers, one principle has always been true: the more accurate and relevant the reporting, the better the leadership’s capacity to make informed decisions. Poor data, on the other hand, can set up even the most brilliant team to flounder or fail.

Elegant dashboard reporting that provides figures on the key drivers of growth, profitability and overall health of an organisation is not difficult to create. It is available to any business – it just requires a leader who sees the business as a whole and demands that all the information they need to lead it is in one place, rather than dispersed across endless spreadsheets, accounting packages, CRM systems and makeshift internal solutions.

With vision, anything can be done

Once created, the results are transformational. Where previously the board or management meetings would have been dominated by interrogating and cross-checking data, and soaked in fear, they can instead be spent making potent decisions. Leaders have at their fingertips figures on exactly what is happening in the business and what levers they can pull to create the change: costs to generate leads and subsequent conversion to sales; accurate figures to measure the effectiveness of sales channels; data on product-purchase trends and profitability by customer and by product group, or tracking volume and frequency of customer purchasing habits. With vision, anything can be done.

What makes the business tick?

But before we can create a reporting system that delivers what leadership needs, we need to understand what really makes the business tick. This requires key questions to be answered. At first, these questions can seem daunting. And not knowing the answers can feel like a failing. However, the process is not a witch hunt. It is is simply moving into the next stage and a necessary part of the evolution of the business. Prior to this point, the answers were not required. Now is the time.

The first questions are primarily around how the business works. They include:

- Does the business’ leadership understand and know what the critical levers of the business are? What generates growth, profit or sales?

- At what speed is leadership presently getting the information they need on key metrics? Do they get it when they need it?

- Does the leadership require real-time reporting, end-of-month or something else? What are the underlying processes that may be inhibiting the ability to produce real-time reporting?

- Can you presently extract information on how each of the business units or product/service offerings is performing? Do you suspect that there are over-performing areas of the business that are masking underperforming areas but don’t have the reporting to really know?

- What are the pain points of the business (for example, slow-paying customers, slow-moving inventory or low sales conversion rates) and do you have reporting to monitor progress on initiatives to improve these areas?

- Is there a budget or business plan that you can monitor performance against? How much was calculated from good data and how much was ‘best guess’?

- Are reports flexible and adaptable or static? Are they future-proofed for new customers or product/service offerings? Are they in a user-friendly format with an ability to drill down into the detail if required?

Poor data, useless reports

The answers to these questions give us an understanding of what information we need in order to be able to drive the business. The next investigation is into the accuracy of the figures in the business. No matter what systems we use, if poor data is going in, then poor data will be turning up in reports, making them useless.

This poses such questions as:

- Does leadership have confidence that the reporting they are getting is accurate?

- What is the quality of the data going into the systems?

- How and when does financial information get into the various systems of the business?

- When can leadership rely on the content of reports and when can they not rely on it?

- Do all of the business’ reports reconcile back to the accounting system – to the ‘source of truth’?

As you can imagine, with these questions answered we are in an incredible position to decide on what needs to be in the reporting dashboard that leadership uses to drive the business. It is only at this point that we can truly decide what relationship is required between all reporting tools in the business. Then we can integrate systems effectively, to extract the actual information we need – rather than have lazy integration, which creates more questions than answers.

Embracing change

This new clarity is so energising that it can seduce us into building the system right away, forgetting that change is inevitable. If you build too fast, what you build could be obsolete in months or weeks. We are in an era that requires business to be agile, innovative and dynamic. To do that, a business system needs to be built to embrace what is coming next: change.

- What happens if we decide to change the accounting structure, e.g. add new categories of products, services or customers, or change the hierarchy of products/services classification?

- What happens if we need to source data from more than one company? A new partner? Or possibly eliminate a source all together?

- Change is coming, and reporting systems that do not allow for it become obsolete quickly, resulting in the investment of time and money being written off.

Speaking the receiver’s language

And lastly in the transformation – the crucial final hurdle – is whether or not leadership can interpret the data. The common error here is that reporting systems do not understand the leader and are created to please the eye of the creator, not the receiver.

Much of my role over many years of reporting to boards and ensuring they had the information they needed, was customising it to the way they wanted to absorb it.

This means asking:

- How can leadership easily understand how to interpret the reports that are put in front of them?

- What is the critical information they really need and is it given priority?

- What ‘red flags’ do they need to look for in their reports?

Sleep at night and thrive during the day

I have learned that for those not immersed in systems and integration on a regular basis, this process seems a mountainous task. To the visionary leader, it presents as a crucial and obvious resource they need to do their role. And to the specialist CFO, it is all taken in our stride. For us, this is just how it is done. This is how all parties can sleep at night and thrive during the day – by knowing what is really happening in their business and what levers they can pull to influence it.

Business insights reporting and your business

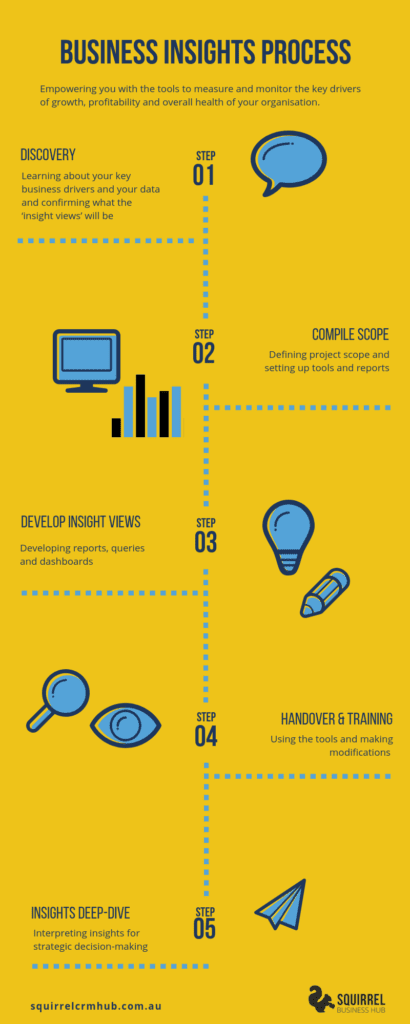

If this is a mountain you need to climb, we have developed a 5-step Business Insights process to guide you. Get in touch to arrange a coffee chat and learn more.

Bronagh Dobson provides CFO services to small and medium-sized businesses in an expansion phase. She has a wealth of experience in finance roles across a number of industries.